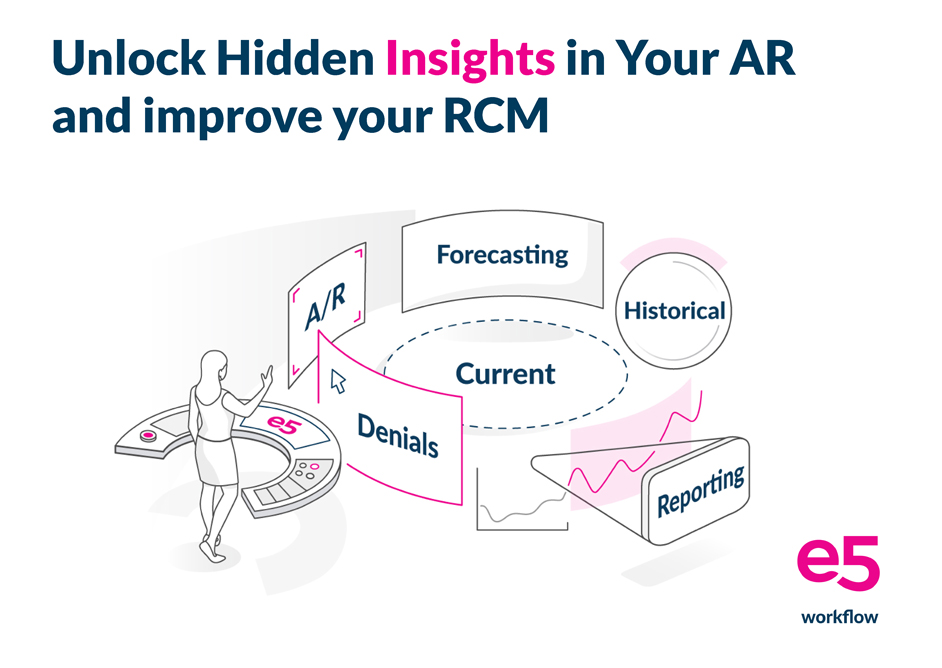

The first thing to do is help you gain insight into your existing outstanding AR. When the e5 team receives your data, we parse it, analyze it, and find existing patterns and areas to attack first to drive cash right now. You may have been previously aware of some of these issues, but there will be others you may not have realized before. Having a fresh set of eyes, and looking at data in a different way, will help your team become hyper-focused on what can be done right now to drive cashflow.

It all depends on how much data and what kind of data you can provide, but here are some examples for areas of focus:

- Who your biggest payors are and where your volume of work is. This may seem like a simple thing, and you may already have a sense of this. But by analyzing your data and utilizing technology to uncover problem areas, we will uncover patterns and payment percentages of specific payors that you may not have been aware of. We can look at both payor groupings and specific payors.

- The type and volume of CPTs you’re billing. This provides a powerful overall view of your business and the types of services you’re performing, the value of those services, and the payors that you’re billing those services to.

- Your biggest types of denials. Being able to determine these denials and see them ranked helps to really understand where your problems are. Many times, we are able to go farther and meld that data together with your payors, which gives a more specific view of where your areas for work are. You can see how these denials from one payor compare to another, and it helps to know where these denials are coming from and potential payors that need to be followed up on.

After we go through and do a thorough investigation of your outstanding AR, we will put together a preliminary list of claims to hit for maximum impact. In this early look, these can be ranked by or based on multiple factors: outstanding highest dollar value, to bring in more revenue; timely filing date, so you can avoid untimely filing denials; or denial type, so you can burn through several claims that will generally be worked the same way. This process is just an example and a simple version of what can be done in our next step: modeling.

We also provide supplemental billing services through e5’s billing team. This supplemental team is called “Flex “and is available to help you power through your denials or other issues, especially if current resources are stretched thin. When we analyze your data, we may also recommend our Flex team and how many people we think would be ideal to help you with your needs. This team is USA-based and will be devoted strictly to your healthcare organization.

As an example, the e5 team worked with a client who had a large problem with their aging balances and potential untimely filing issues. Based on the data they provided to the e5 team, we were able to determine who their payors were with the highest amounts of no payment for balances over 120 days old. For this client, their high payors were Medicare, Medicaid and Blue Cross. All of the client’s outstanding claims were loaded into the e5 software, and were automatically prioritized exactly on which claims to work first, balancing between highest balance and filing deadlines. Three members of the e5 Flex billing team jumped in – one on each payor – and, by utilizing the e5 software’s next best claim technology, the e5 billing team worked all the 91+ days outstanding claims within two months.

The goal is to utilize your data to provide fresh and pertinent insights into your business that will drive immediate cashflow and improve margins. We want to help you find the right strategies to attack your outstanding balances in a more effective and efficient way, and your data is the first step to uncovering those insights to improve cashflow.